Report Summary Total incentives planned for power distribution companies (Discoms) is capped at USD 2 Billion for installing about 35 GW of rooftop capacity

Solar Rooftop Market Outlook in India and Impact Analysis of SRISTI Scheme till 2022

Share Report

License Type

In addition to single user license

- About

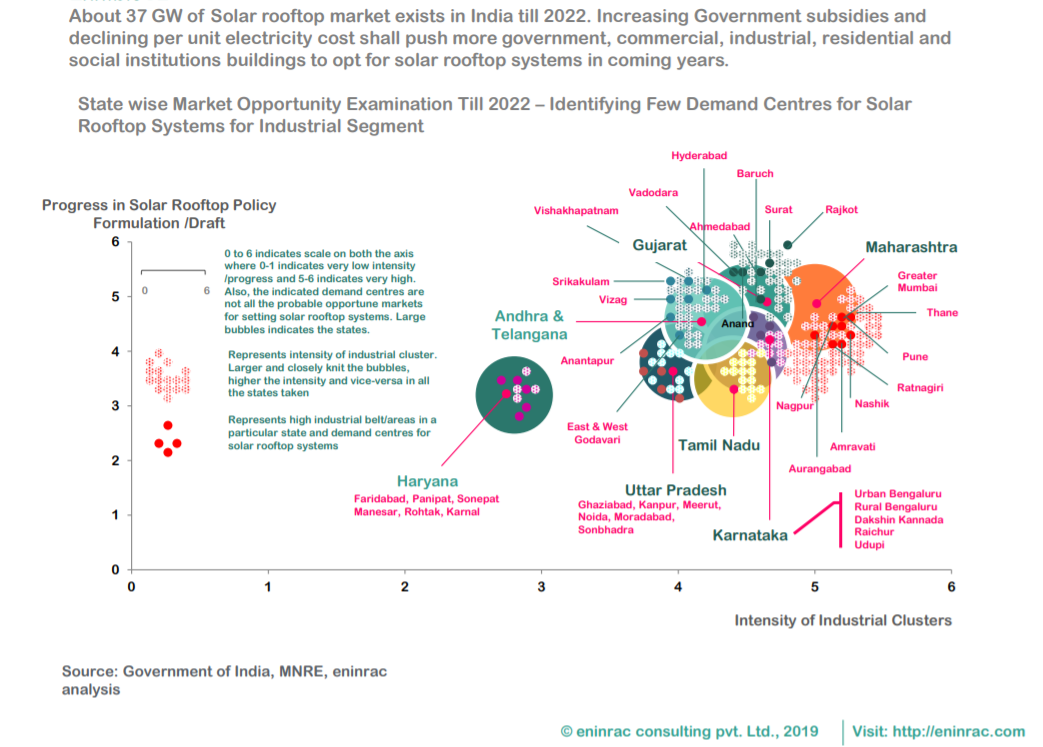

Examining state wise opportunities for grid connected solar rooftop applications and market sizing for discoms, OEMs, EPC contractors, project developers into residential, industrial , commercial and government segments

Government of India is projected to make an investment by giving subsidies to the amount of USD 3.3 Billion for scaling up the solar rooftop installations in the country under “Sustainable Rooftop Implementation for Solar Transfiguration of India” (Sristi) Scheme

Total incentives planned for power distribution companies (Discoms) is capped at USD 2 Billion for installing about 35 GW of rooftop capacity

The economics of solar power has improved in India. It’s a far more cost-competitive source of electricity generation than it was a decade back or more. The sharp decline witnessed in the module and installation cost of the solar photovoltaic systems in the country and all across the globe has been a significant reason for such a development, and have also pulled up the solar power capacities higher than before. Presently, India boasts a solar power installed capacity of 24 GW , which was not even 1 GW in mid 2000’s. Solar’s changing economics is already influencing the business consumption and investments and given the push from Indian government the sector is progressing towards a multi-faceted growth. Talking about consumption, a new demand segment for solar power is picking up the trend i.e. solar rooftops. Good number of companies especially the PSUs with large physical footprints and high power costs are switching towards installing commercial scale rooftop solar systems, often at less than the current price of buying power from a discom. Also, for the industrial belts where power requirement is massive and congestion in the transmission lines is also high, rooftop systems can be utilized to get some respite. For instance, as per the latest developments it is to be noted that the premises of Power Grid Corporation in Madhya Pradesh shall be installing solar rooftop systems for its self consumption and is anticipated to get the electricity at a tariff of INR 1.58/ unit , which is way cheaper than what they use to pay erstwhile to the discoms. Similarly many other government buildings in the state have decided to go ahead with solar rooftop systems with the per unit electricity cost to be INR 1.67. This has been achievable with the deployment of RESCO programme in the state. The RESCO model facilitates the beneficiary consumer to buy solar power with zero upfront investment and at a tariff much below the prevailing DISCOM rates. Likewise, the government has been coming out various other schemes, policies and incentives for increasing capacity additions from solar rooftop systems in order to achieve the target of 40 GW by 2022.

BUSINESS CASE FOR SOLAR ROOFTOP SEGMENT IN INDIA

- 40 GW of grid connected solar power capacity in India is targeted to come through rooftop solar power installations by 2022

- In a bid to promote production and usage of non-conventional energy in the State, Chhattisgarh government approved the solar power policy in June 2017- under which grid connectivity facility shall be provided upto 10 kilowatt

- Grid connected solar rooftop and small solar power plants programme to scale up a budget from INR 600 crores during 12th FYP to INR 5000 crores for implementation over a period of five years upto 2019-20 under National Solar Mission (NSM)

- 15% government subsidy for non-commercial and non-industrial categories for using domestic solar panels

- With constant effort of the Ministry, State Electricity Regulatory Commissions of seventeen states have notified regulatory framework on net-metering /feed-in tariff to encourage rooftop solar plants

- Government proposes INR 23,450 crores of rooftop solar scheme named SRISTI

- In many Indian states and market segments, the levelized cost of electricity (LCOE) of rooftop solar is already lower than the existing average grid rates of tariffs

- Rooftop solar is already achieving grip parity in the residential sectors in states such as Uttar Pradesh, Maharashtra and Rajasthan

- In the government sector rooftop solar has become competitive in Delhi, Uttar Pradesh , Karnataka, Haryana and Andhra Pradesh

- In other states , the gap b/w rooftop solar and conventional sources of electricity is fast decreasing

- TOC

- USPs

- Key Highlights

- Report Insights

- Must Buy For

Get your report flyer

Download the flyer to learn more about:

- Report structure

- Select definitions

- Scope of research

- Companies included

- Additional data points