Report Summary Power distribution utilities rely on tariffs to generate revenue, cover expenses, and fund network expansion. While this business model appears sound, many distribution companies (discoms) still suffer significant losses.

Power Distribution Tariffs in India - 2024

Share Report

License Type

In addition to single user license

- About

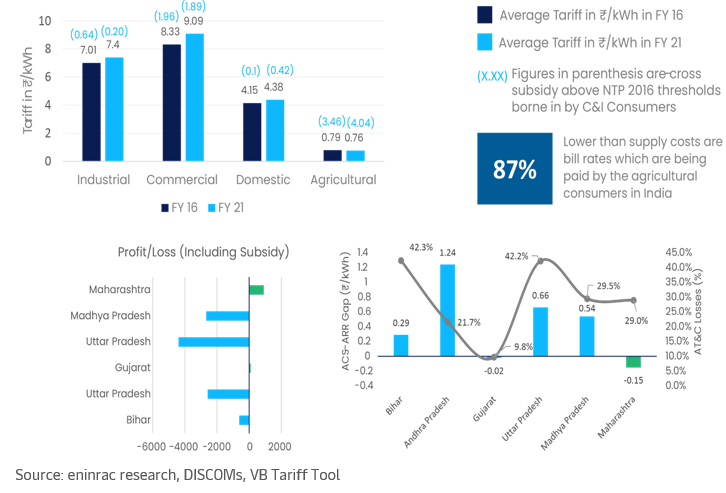

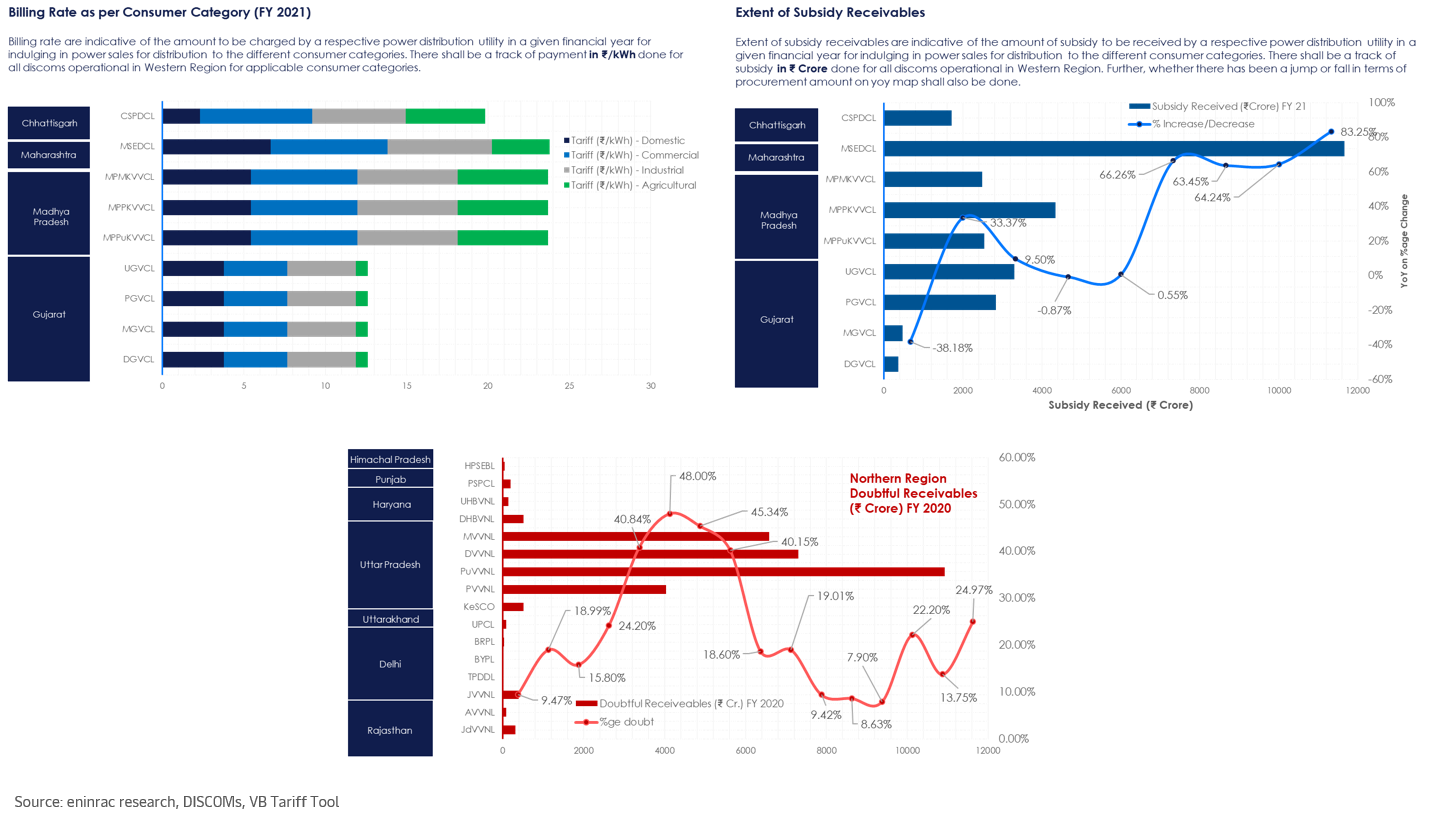

Power distribution utilities rely on tariffs to generate revenue, cover expenses, and fund network expansion. While this business model appears sound, many distribution companies (discoms) still suffer significant losses. This raises the question: Where does the system falter? Is it due to discoms prioritizing consumer interests or the authorities' attempts to create politically acceptable policies?

Achieving an unbiased understanding of power distribution is complex, but it is clear that the authorities' intentions can impede the financial stability of discoms. This ongoing issue highlights the need for tariff rationalization as a potential solution. As of April 2024, power distribution tariffs vary significantly across different states in India. For instance, Delhi charges around ₹4-5 per kWh for residential consumers using up to 400 units per month, while states like Maharashtra have higher rates, approximately ₹8-9 per kWh for similar consumption levels. This disparity in tariffs reflects the broader challenges in aligning costs and revenues.

One critical factor is the lack of a mandate for state discoms in India to adjust their supply costs annually. Additionally, net metering payouts are based on the average cost of electricity supply or the cost of supply for only 8-9 of the 29 states. So, why aren't discoms adjusting their tariffs accordingly? The cost of generating electricity has risen, especially for thermal power, due to increased fuel costs and technological advancements aimed at reducing emissions.

- TOC

- USPs

- Key Highlights

- Report Insights

- Must Buy For

- Companies Mentioned

Get your report flyer

Download the flyer to learn more about:

- Report structure

- Select definitions

- Scope of research

- Companies included

- Additional data points