Report Summary The prime focus of central and state government is to uplift the deteriorating condition of the Indian Distribution utilities through more pragmatic approach

Power Distribution Tariffs in India 2020

Share Report

License Type

In addition to single user license

- Summary

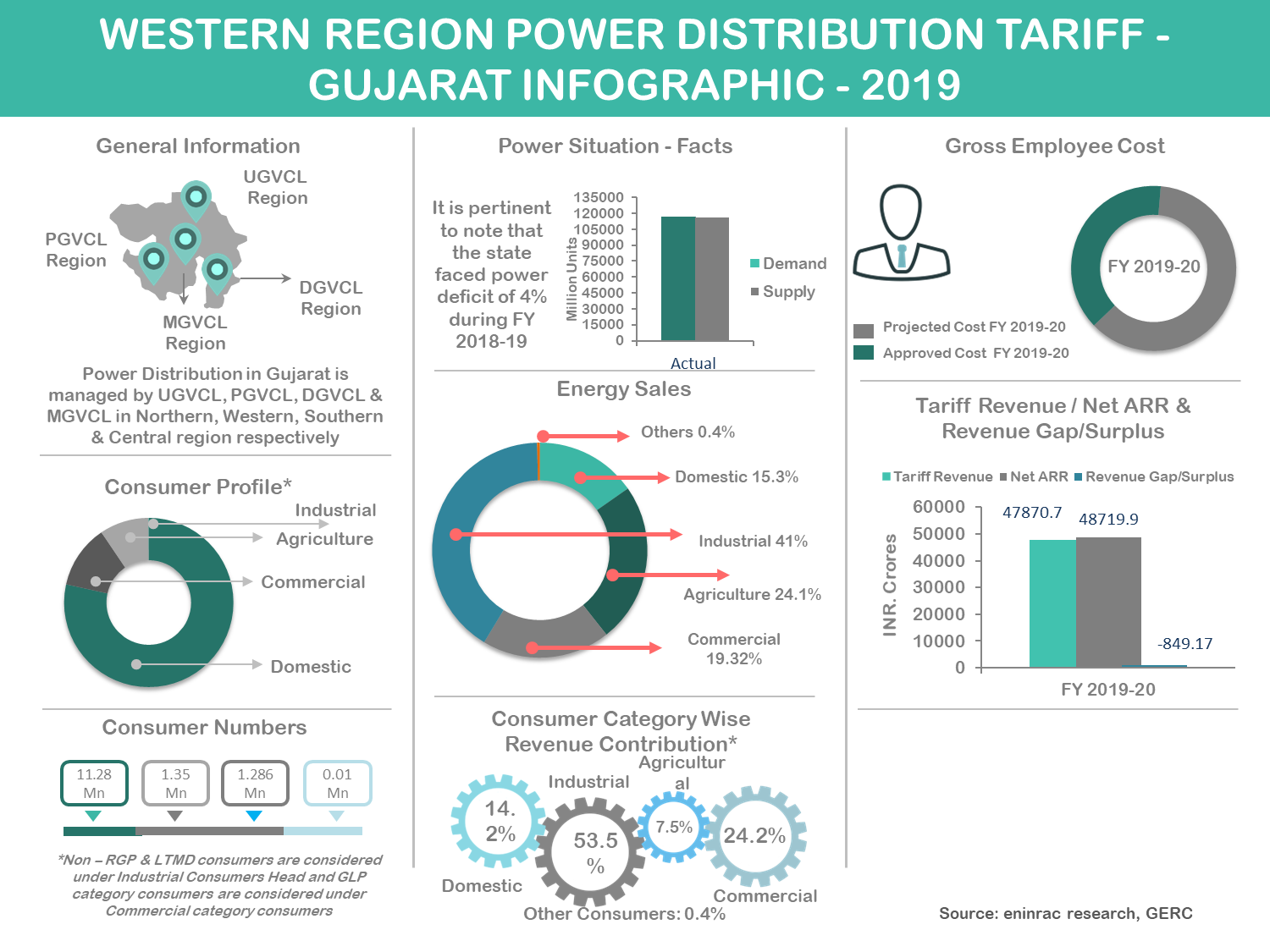

THE GOVERNMENT FOCUSSING TO FINANCIAL TURNAROUND OF THE DISCOMS AND TURNING THE DISCOMS MORE PROFITABLE APART FROM KEEPING THE INTERESTS OF BOTH THE POWER DEVELOPERS AND END CONSUMERS INTACTThe power sector has come a long way with significant achievements on many fronts such as a doubling of conventional power generation capacity since 2012 with active private participation, renewables increasing from 2 to 12 percent of the energy mix since 2015, introduction of financial restructuring reforms for distribution companies to limit the AT&C loss levels to minimum levels. Having said that, despite implementation of structural reforms in power distribution segment of India, it still represents the weakest link of the power segment. Despite considerable progress in implementing the EA mandates and associated policies over the past decade, the distribution segment continues to post significant losses. With, India having most of the discoms run as state authorities the operational efficiencies and targeted revenue remains underachieved. However, few states like Gujarat and Karnataka put up excellent efforts to reduce the AT&C loss levels which currently stood at nearly 10% and 14% well below the national average of 21.5% in 2019.However, despite best efforts from Government it was difficult for the discoms to turn the tide and become profitable. Therefore, following the quest of discoms to become a profitable business, certain decisive moves are being adopted by the central Government:

- The central government proposes to rationalise the discoms tariff structure to improve the operational efficiency.

- It is proposed that cross-subsidies are reduced and the tariff for all consumer categories are brought within ±20% of the average cost of supply

- New tariff norms 2019-24 are likely to push the average cost of supply higher.

- Recently announced in Union budget 2020 is Concessional Tax Rate for Electricity Generation Companies. New provisions were introduced in September 2019, offering a concessional corporate tax rate of 15% to the newly incorporated domestic companies in the manufacturing sector which start manufacturing by 31st March, 2023. This clearly signifies the reduction in power generation cost that will help in aiding the weak financials of discoms in the future.

BUSINESS CASE FOR POWER DISTRIBUTION TARIFFS IN INDIA- New CERC draft tariff regulations for control period 2019-2024

- Thrust given to add power generation capacity (Renewable and Thermal): A move to create “one market in power”

- Long overdue reforms of Discoms in terms of adequate and rational tariff structure may get addressed by these norms

- Energizing the development of Renewable Sector

- The new paradigm of surplus power sets the stage for new reforms

- Move to rationalise power tariff structure

- Push to “Make in India” initiative

- Increased quantum for Open Access in India

- Reduction in the short-term power procurement

- TOC

- Key Highlights

- Database Difference Margin

Get your report flyer

Download the flyer to learn more about:

- Report structure

- Select definitions

- Scope of research

- Companies included

- Additional data points