Report Summary Market Opportunity Analysis for Stressed Assets and Non-performing assets vis-à-vis Investment and M&A Drive for Foreign Players

Investment Opportunities Track in Stressed Thermal Power Assets of India & Projects Database – 2018

Share Report

License Type

In addition to single user license

- About

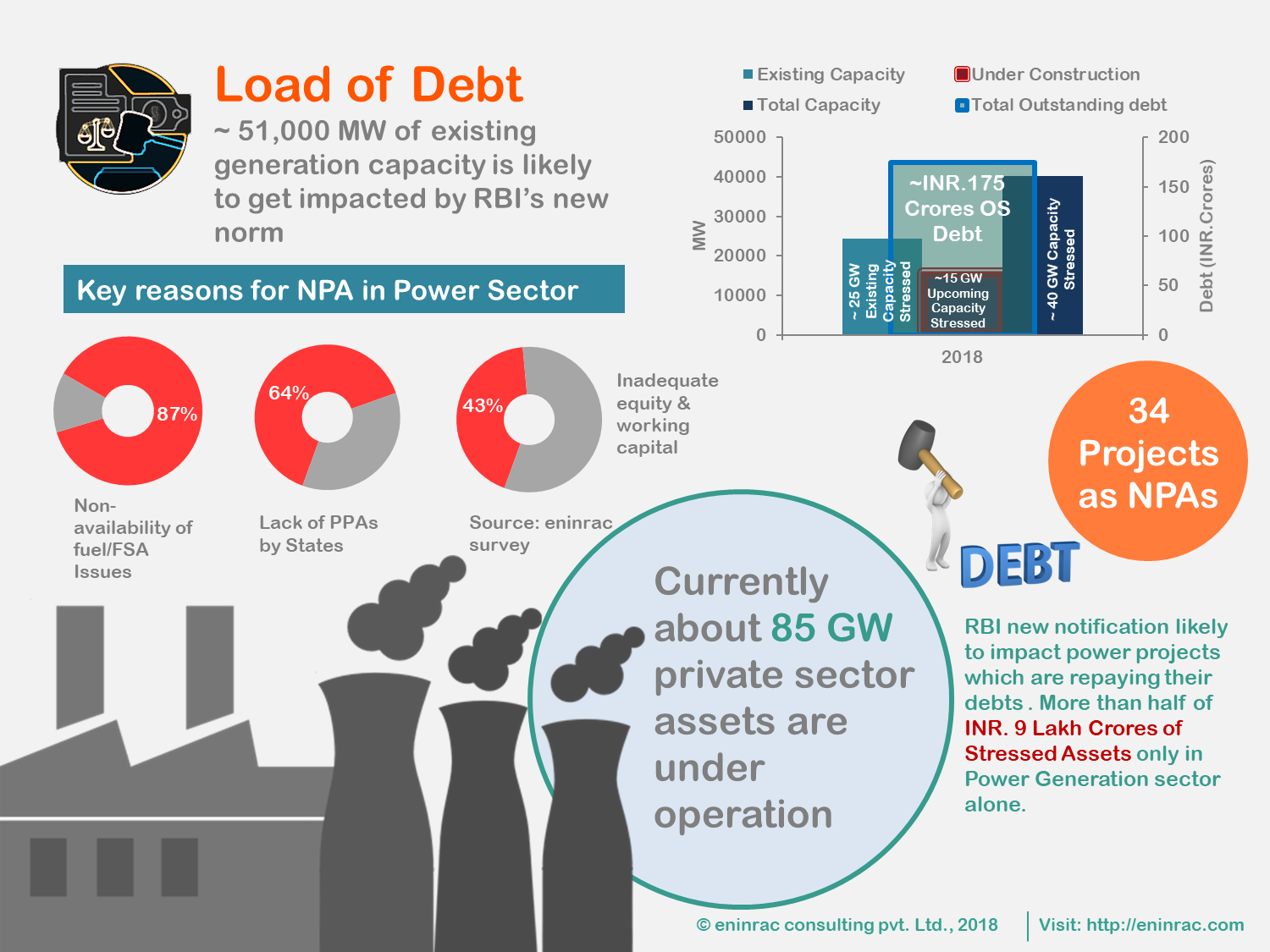

Currently, as identified by the Government 34 projects by the independent power producers do fall under the stressed category with 15 GW of upcoming and 25 GW of existing capacity are stressed. These assets are those which have slipped into to stressed assets owing to their slippage from watch list. Following such massive capacities already in the stressed category and further with new norms of RBI in place another good 50 GW of capacity is likely to be hit and demarcated under stressed assets which shall also have capacities of NTPC and SEBs.

India has seen tremendous growth rate in terms of capacity additions in thermal power capacity in the country specially post the spruced up participation by private developers. Currently the country boasts a cumulative capacity of 85 GW by independent power producers, of which most of the operators have the threat lurking on them to be pushed into NPA category. With growing burden on the IPPs close 40 GW of the 85 GW are qualified as stressed assets. The stressed assets also comprise of NPAs and those who all in likelihood may transform into one.

Key Queries Resolved

- What shall be in-store for India owing to the stressed thermal power assets?

- Who are the willful defaulters in thermal power plant category across different regions and states in the country?

- What shall be scale of opportunity for investments in the stressed assets and good NPAs?

- What are the stressed assets which are affected due to lack of fuel supply and which are the assets which may slip into NPAs due to this reason?

- What are the stressed assets which are affected due to lack of PPA’s and which are the assets which may slip into NPAs due to this reason?

- What are the stressed assets which are affected due to inadequate equity capital and which are the assets which may slip into NPAs due to this reason?

- What are the stressed assets which are affected due to contractual/tariff related issues and which are the assets which may slip into NPAs due to this reason?

- What are the stressed assets which are affected due to project implementation and aggressive bidding by developers and which are the assets which may slip into NPAs due to this reason?

- How the financial & operational viability for the NPAs to be assessed to ascertain investment drive or M&A drive in them?

BUSINESS CASE FOR INVESTMENT OPPORTUNITIES IN STRESSED AND NON-PERFORMING THERMAL POWER ASSETS

- With new RBI norms in place close to 51 GW of fresh capacity may become stressed and slip into NPAs presenting huge opportunity for companies like NTPC & Tata Power to articulate strategic acquisition in the country

- Currently 25 GW of thermal plants are under NPA category and another 15 GW under stressed category and among this cumulative capacity scores of good assets are present which need in-depth due diligence for robust investments

- Given the assimilation of stressed assets across the country chance of bankers and lenders going for a debt restructuring is certain and that opens entire market for FDI as power generation business is open for 100% of it

- For the assets of SEBs which may slip under the NPA category from the stressed one’s owing to lack of equity capital or operation management issues there exists an opportunity to bail out and sell off their assets to the effective owner with affecting PPAs

- For the IPPs which are struggling with issues of FSA and PPAs from the discom’s it shall be best opportunity for such players to have recovery of their assets or simply exit through by engaging in profitable M&A drive

- TOC

- USPs

- Key Highlights

- Report Insights

- Must Buy For

Get your report flyer

Download the flyer to learn more about:

- Report structure

- Select definitions

- Scope of research

- Companies included

- Additional data points