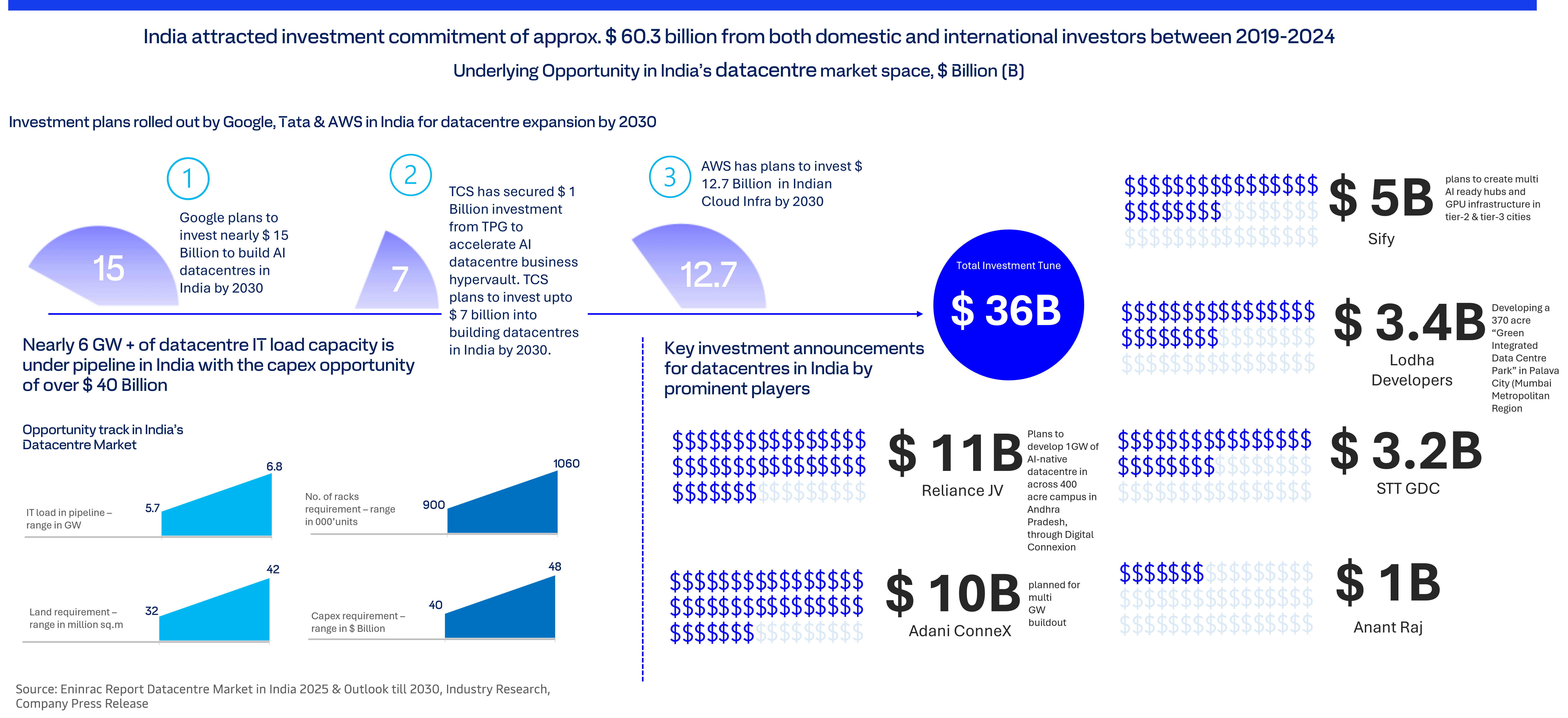

Report Summary India’s datacenter industry is entering a sustained structural growth trajectory, driven by progressive policy reforms, rapid 5G proliferation, and accelerated cloud adoption. Between 2024 and 2030, anticipated investments of USD 10–12 billion are set to fundamentally reshape the ecosystem—spanning IT hardware, power infrastructure, advanced cooling systems

India Datacenter Market Outlook : A Strategic Perspective To 2030

Share Report

License Type

In addition to single user license

- About

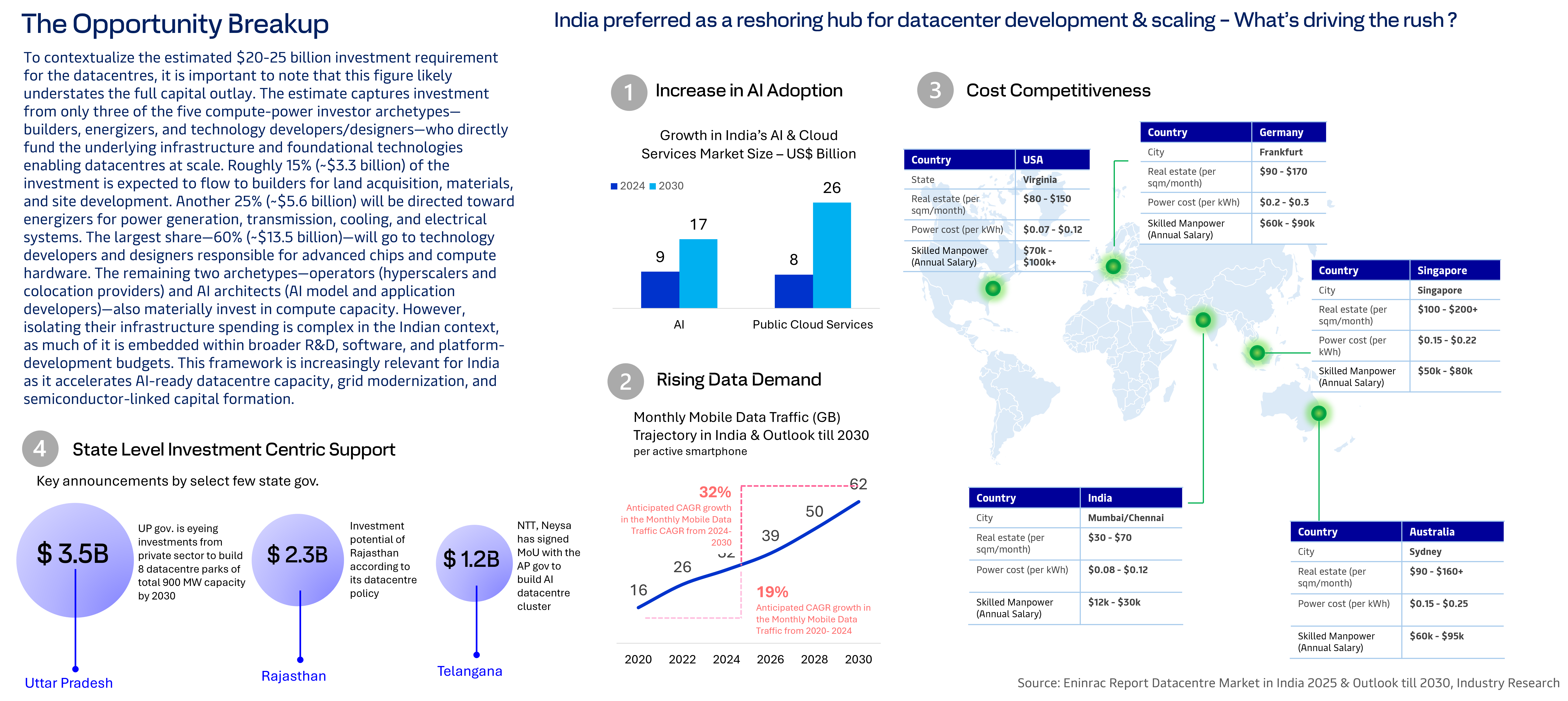

India’s datacenter industry is entering a sustained structural growth trajectory, driven by progressive policy reforms, rapid 5G proliferation, and accelerated cloud adoption. Between 2024 and 2030, anticipated investments of USD 10–12 billion are set to fundamentally reshape the ecosystem—spanning IT hardware, power infrastructure, advanced cooling systems, and large-scale construction. Growth will continue to cluster around Mumbai, NCR, Hyderabad, and Chennai, which are emerging as the country’s core hyperscale hubs. Parallelly, edge datacenter deployments will scale to enable latency-sensitive use cases across telecom, automotive, and urban infrastructure. Sustainability is becoming a decisive procurement criterion, with renewable energy sourcing and high-efficiency cooling architectures evolving from differentiators to baseline expectations. The industry value chain is also shifting toward software-driven and service-led operating models, unlocking higher-margin, recurring revenue pools.

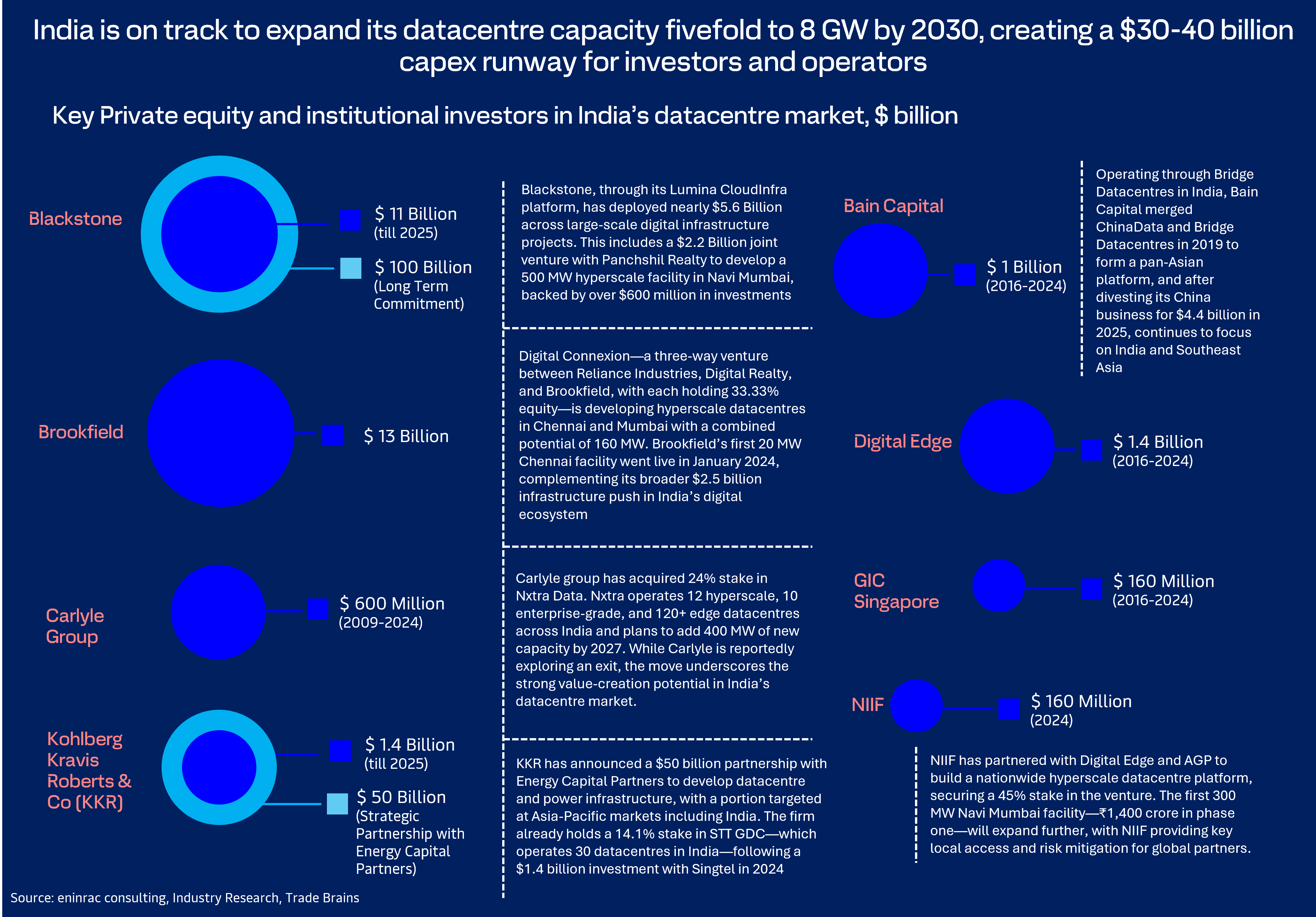

Against this backdrop, global private equity investors are sharply increasing their commitments to India’s digital infrastructure sector, attracted by resilient, data-linked returns and the nation’s aspiration to build a USD 1 trillion digital economy by 2030. Capital deployment is intensifying across edge facilities, AI-ready hyperscale campuses, and scalable fibre networks. Since 2020, more than USD 15 billion has already been committed and deployed, with a further USD 20–25 billion expected by decade-end. This momentum positions India as one of the fastest-growing and most strategically significant digital infrastructure markets globally. - TOC

- USPs

- Key Highlights

- Report Insights

- Must Buy For

- Companies Mentioned

Report FAQs

What is driving the rapid growth of India’s data center market?

How much investment is expected in India’s data center sector by 2030?

Which cities are emerging as major data center hubs in India?

What are the key opportunities across the data center value chain?

Why is India becoming a preferred global hub for data center development?

Get your report flyer

Download the flyer to learn more about:

- Report structure

- Select definitions

- Scope of research

- Companies included

- Additional data points