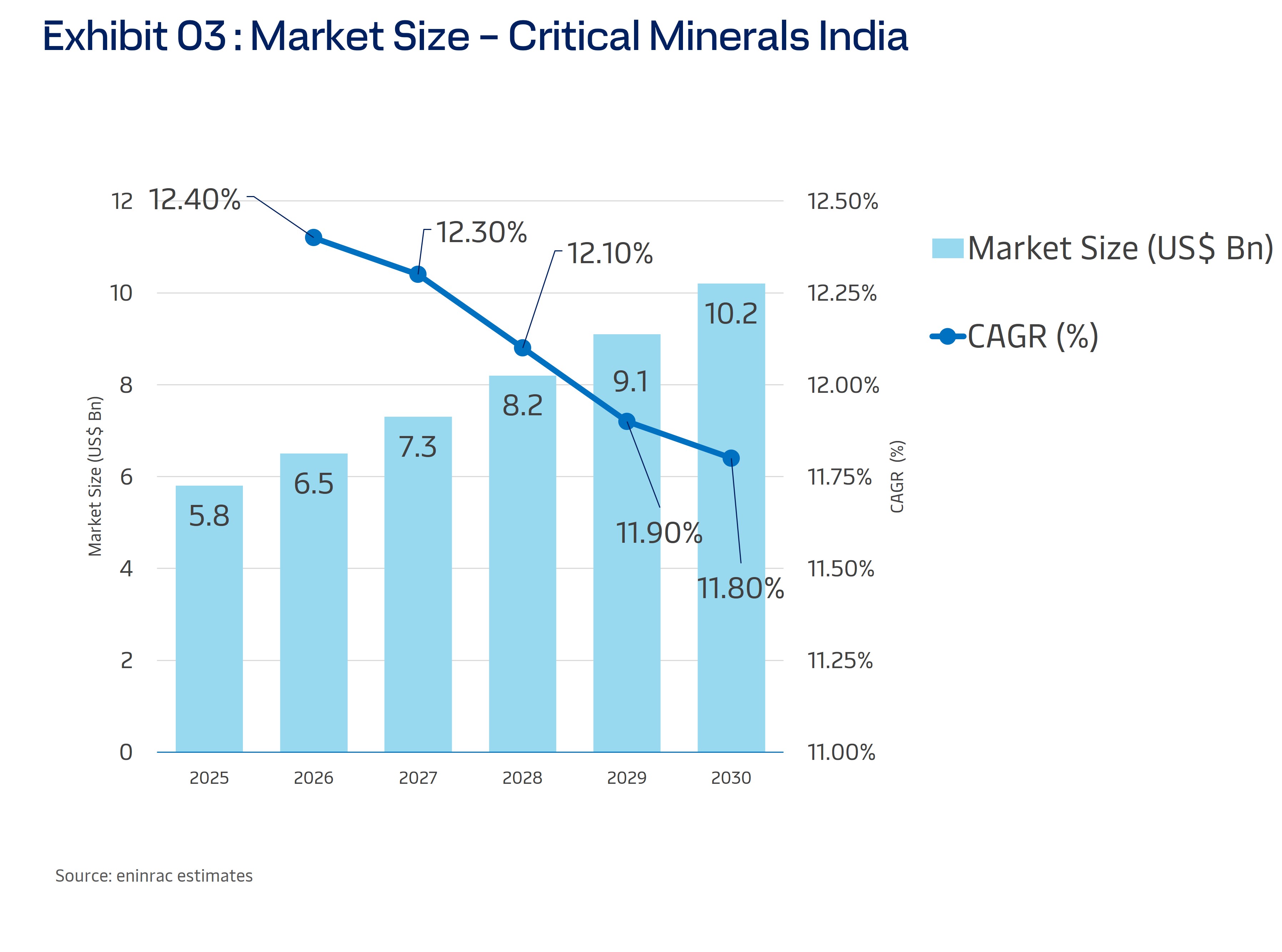

Report Summary India’s critical minerals market is projected to surpass ₹1.2 lakh crore (approx. US$15 billion) by 2030, fueled by accelerating EV adoption, renewable energy expansion, and industrial modernization. With robust government initiatives like the National Critical Minerals Mission and growing export potential, the sector presents a ₹2.5 lakh crore (US$30 billion) opportunity over the coming decade.

India Critical Minerals Market 2025-2030: Domestic, Export, Value Chain, Investment Trends And China Comparison

Share Report

License Type

In addition to single user license

- About

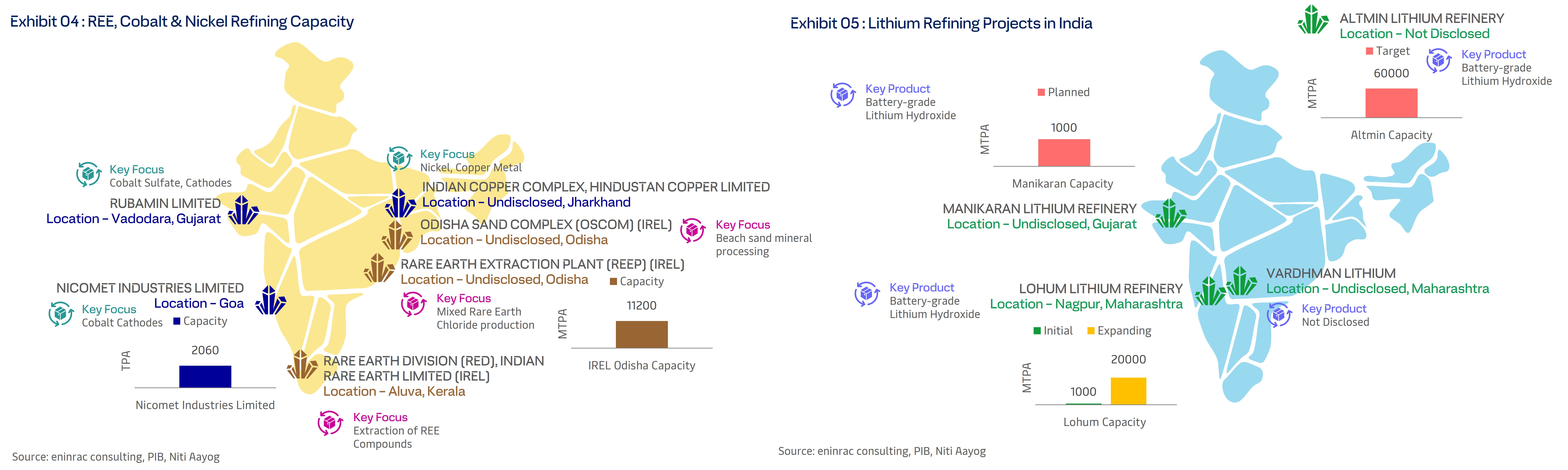

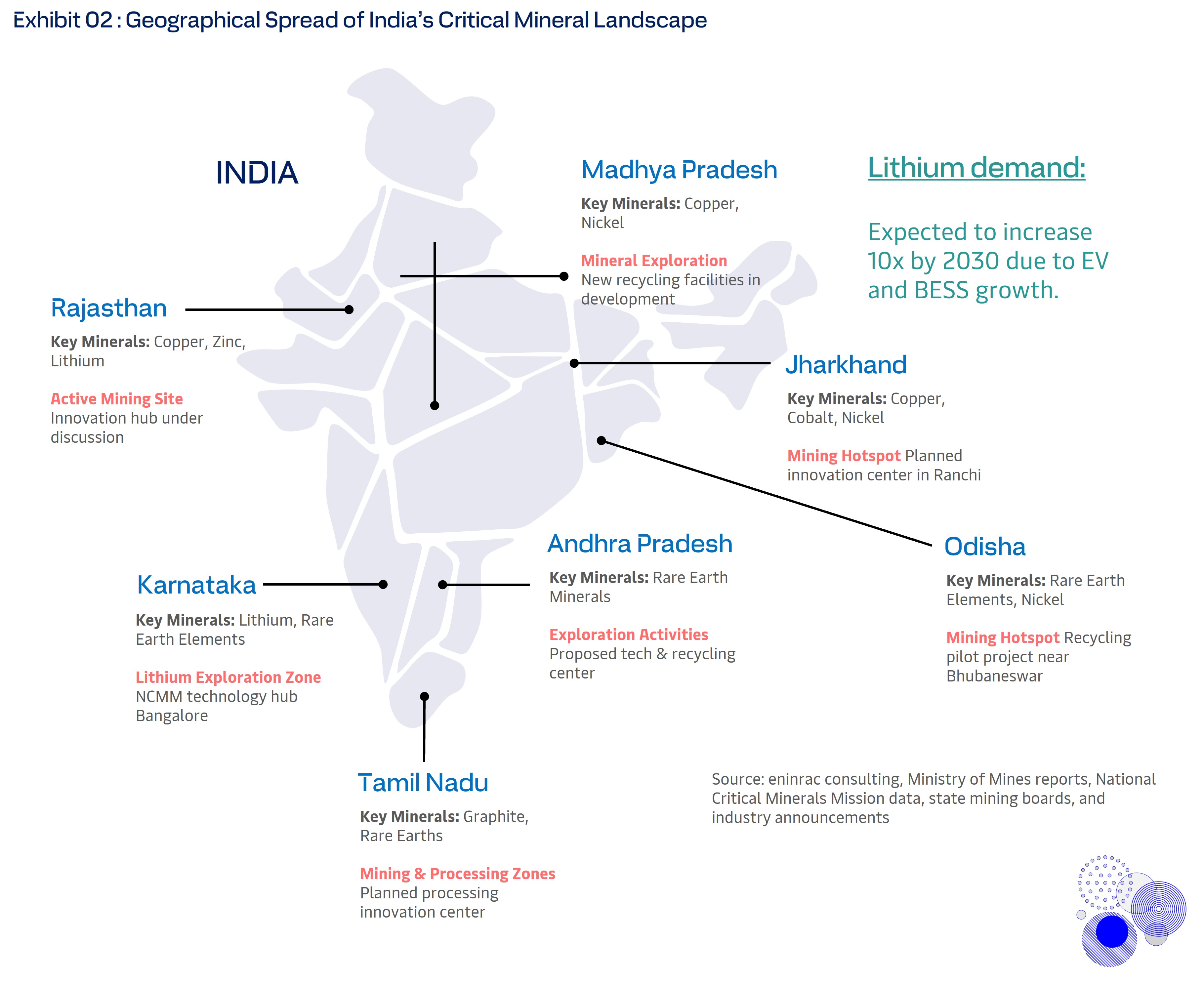

India has identified five critical minerals like Lithium, Cobalt, Nickel, Copper, and Rare Earth Elements and remains pivotal for driving its clean energy transition and achieving technological independence. The launch of the National Critical Minerals Mission (NCMM) in 2025 marks a transformative initiative to secure domestic supply chains, boost exploration, and cut reliance on imports. With a combined government and private investment outlay exceeding ₹34,000 crore for 2025-31, the mission aims to identify 1,200 deposits, scale recycling capacities, and foster innovation through Centres of Excellence.

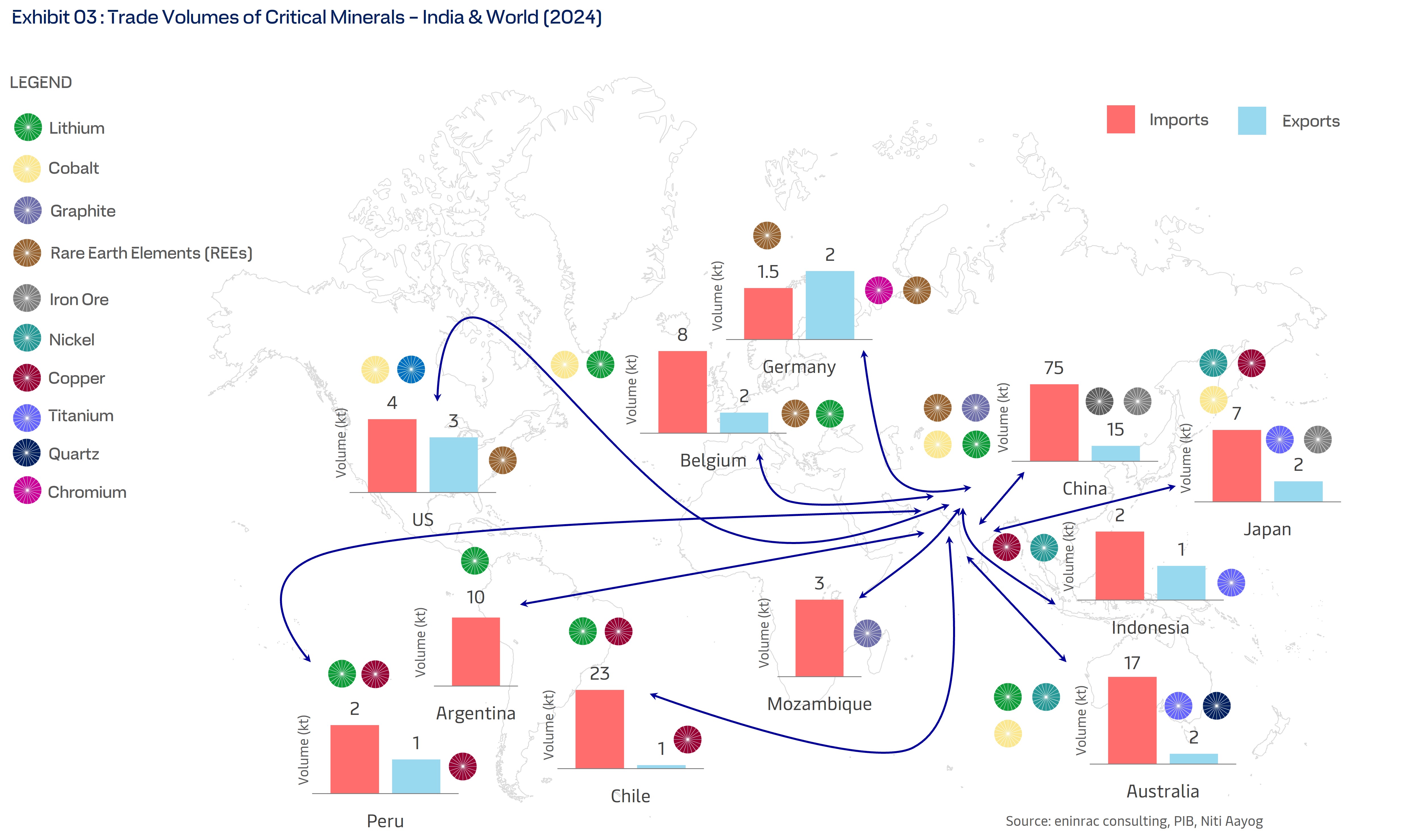

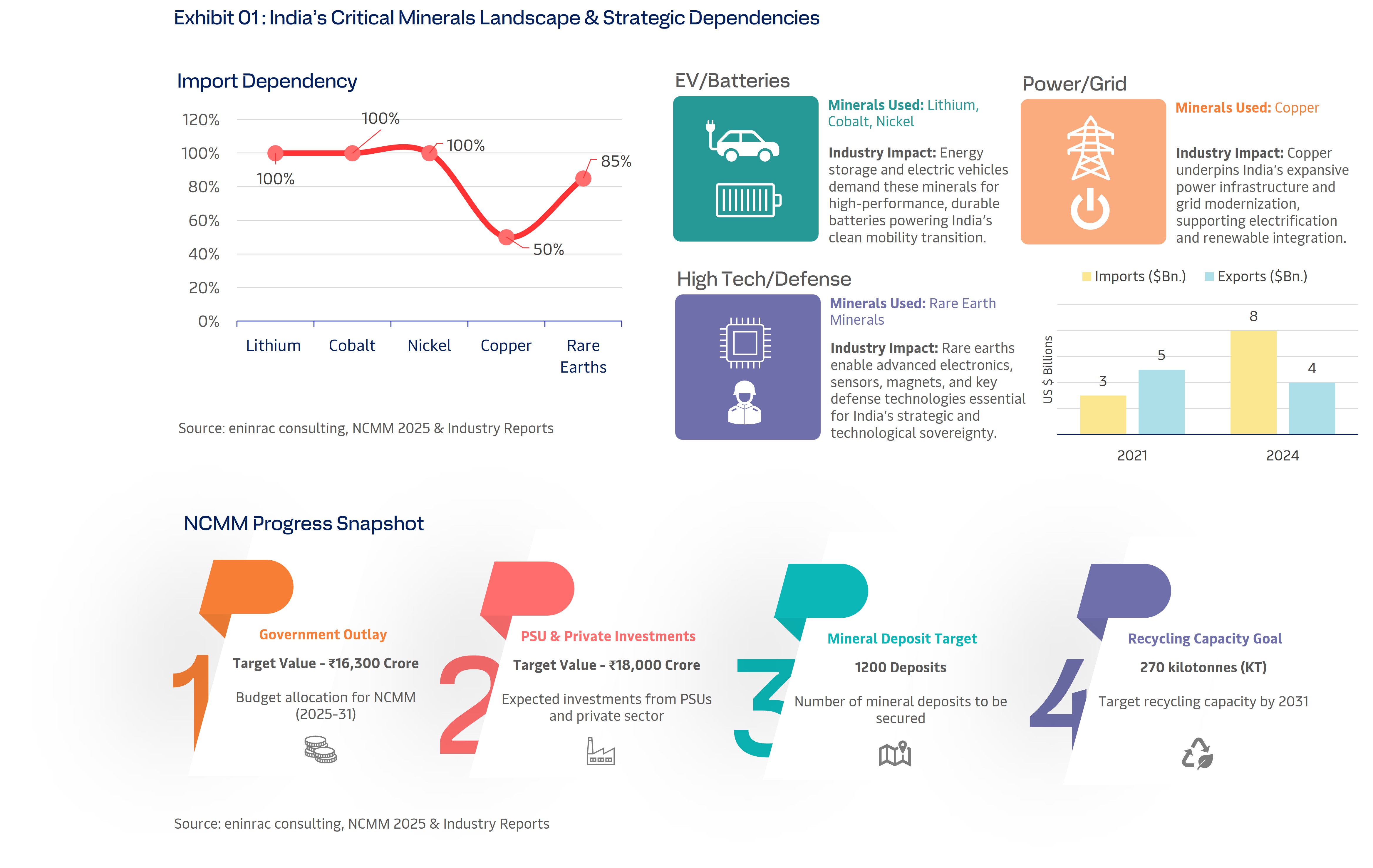

Despite these efforts, India continues to face high import dependence, ranging between 70% and 100%, particularly for minerals like lithium, cobalt, and nickel that are essential for battery manufacturing and EV production. This dependency underscores the strategic urgency to enhance domestic production capabilities and diversify sources internationally to reduce geopolitical risks and supply disruptions. The critical minerals prioritized underpin key sectors such as electric vehicles, renewable energy, advanced electronics, and defense. Lithium, cobalt, and nickel predominantly serve batteries and alloys, while copper is vital for power infrastructure and grid modernization. Rare earth elements, crucial for high-tech and defense applications, have a significant import footprint on India’s supply chain, necessitating focused domestic capabilities. India’s critical minerals sector faces significant import dependency risks, especially for lithium, cobalt, nickel, and rare earth elements, all crucial for the country’s clean energy ambitions. This heavy reliance underscores the urgency for domestic resource development and diversification of import sources. - TOC

- USPs

- Key Highlights

- Report Insights

- Must Buy For

- Companies Mentioned

Report FAQs

What are the key growth drivers for India’s critical minerals market through 2030?

Which minerals are considered critical for India’s clean energy transition and technological independence?

What is India’s current import dependency for critical minerals and why is it a strategic concern?

How is the government addressing import dependency and supporting domestic production?

What is the outlook for investments and opportunities in the sector by 2030?

How does India's market and value chain compare with global leaders like China?

Who are the major companies and stakeholders in India’s critical minerals ecosystem?

Get your report flyer

Download the flyer to learn more about:

- Report structure

- Select definitions

- Scope of research

- Companies included

- Additional data points