Report Summary Assessing New Business Opportunities for Fuel Suppliers, Feedstock Suppliers, FBOs Oil Marketing Companies, Auto Players, and Other Value Chain Players

Emerging Biofuels Market in India and Outlook Till 2025

Share Report

License Type

In addition to single user license

- About

12 number of 2G Ethanol Biorefineries are planned to be set up in India by 2024. Pradhan Mantri Jivan Yojana supports 12 Commercial Scale and 10 demonstration-scale Second Generation (2G) ethanol Projects with a Viability Gap Funding with a total financial outlay of INR 1969.50 crore for the period 2018-19 to 2023-24.

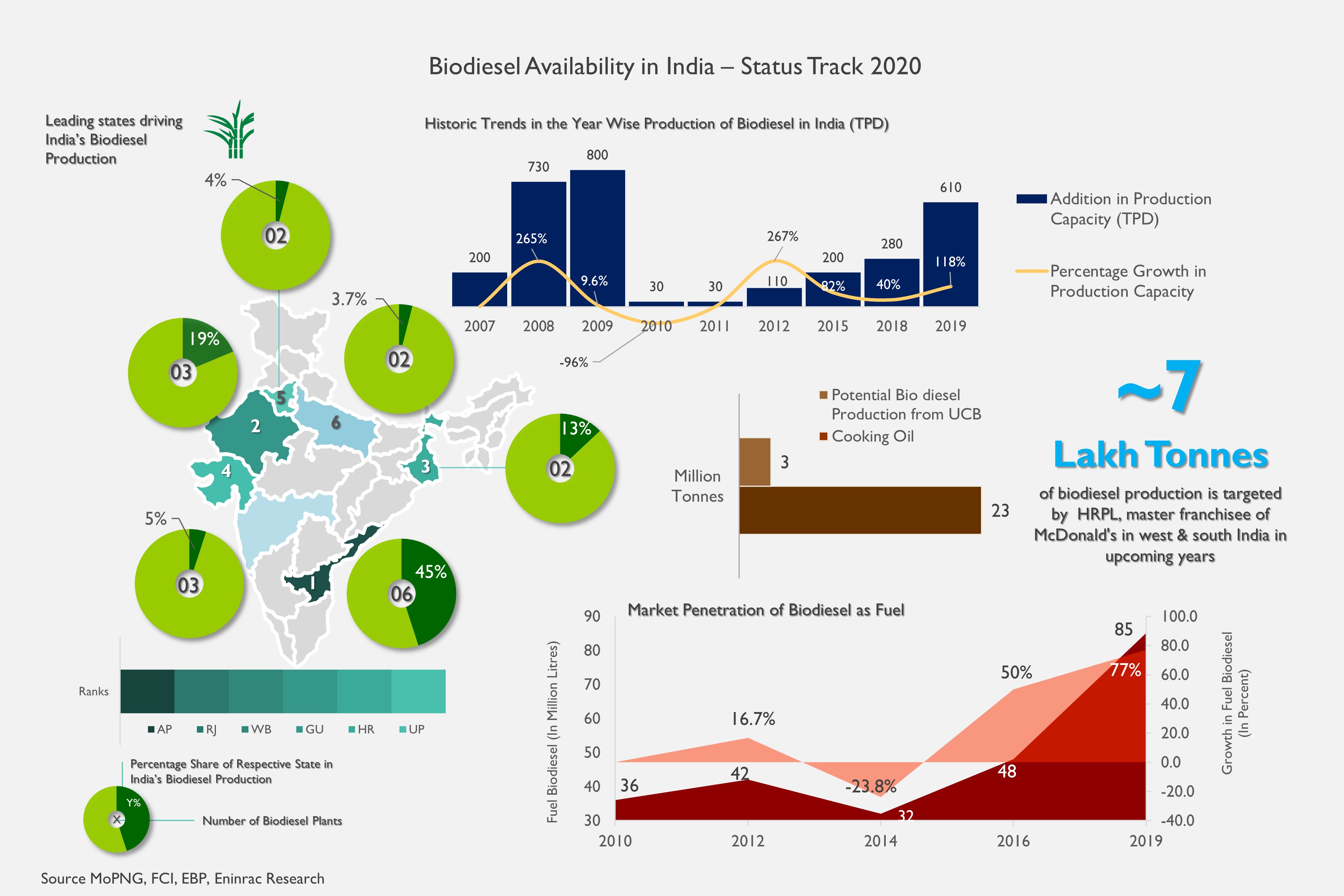

The National Biofuel policy 2018 seeks to achieve a national average of 20% blending of ethanol in gasoline and indicative target of 5% blending of biodiesel in diesel by 2030.

Becoming carbon neutral is one of the most acute challenges that countries across the globe are currently dealing with. The global movement to reduce greenhouse gas emissions continues to gain momentum across the auto industry as well and is adding pressures to the automakers and suppliers to switch to a cleaner mode of transportation by either going electric or adopting green fuels. In this lieu, significant impetus has been given on developing biofuels – ethanol, biodiesel and Bio CNG. The market for biofuels increased based primarily on demand from the transport sector, especially road vehicles, which use biofuels either in pure form or blended into conventional fossil fuels (example. diesel or gasoline). Moreover, since 2006 alternative markets for biodiesel and bioethanol, beyond their core usage in road transport, have emerged globally. Several developed and developing countries have established (and continue to pursue) regulatory standards for biofuels since 2006, including blending targets and sustainability norms. India being no aberration has also initiated the development biofuels in the country. As per India’s National Biofuel Policy 2018, the country aims to achieve national average of 20% blending of ethanol in gasoline and indicative target of 5% blending of biodiesel in diesel by 2030. Presently, the global biofuel production hovers around 143.9 Billion Litres, with US leading the overall availability. Currently, the Indian market is at very nascent stage in terms of producing both ethanol and biodiesel but the growth that has been witnessed over the last decade in the production of ethanol, India is likely to capture a global market share of 2% by 2025. It is significant to note that the total production capacity of alcohol and ethanol in India as on March 2021 stands to be 684 crore litres, of which the public sector oil marketing companies (OMCs) have allocated 325.5 crore litres which is to be procured during the ongoing Ethanol Supply Year (ESY) 2020-21 (December 2020 to November 2021) for Ethanol Blended Petrol (EBP) Programme. GoI has further allowed sugarcane and food grain based raw materials for ethanol production and in order to blend 10% ethanol in petrol by OMCs. Based on the offers received during ESY 2020-21, Public Sector OMCs have allocated 3.43 crore litre of ethanol to be procured from surplus rice sourced from the Food Corporation of India (FCI) and 38.42 crore litre from Damaged Food Grains (DFG) unfit for human consumption and maize. The combined allocation from rice, DFG/maize is 12.86% of the total allocation for ESY 2020-21. Additionally, in order to encourage the production of ethanol in the country, the government has allowed sugar mills/distilleries/private entrepreneurs to set up ethanol plants freely anywhere in India for production of ethanol after obtaining statutory clearances and has also notified an interest subvention scheme to assist setting up of these ethanol production plants in the country.

Further, subsequent to the opening of an alternate route i.e. Second Generation (2G) route for Ethanol production Public Sector OMCs – IOCL, HPCL, BPCL, NRL and MRPL have planned to set up 12 number of 2G Ethanol Biorefineries in 11 States across the country. To incentivize 2G Ethanol sector and support this nascent industry by creating a suitable ecosystem for setting up commercial projects and increasing Research & Development, GoI in 2019 launched "Pradhan Mantri DIVAN (Jaiv lndhan- Vatavaran Anukool fasal awashesh Nivaran) Yojana" as a tool to create 2G Ethanol capacity in the country and attract investments in this new sector.

- TOC

- USPs

- Key Highlights

- Report Insights

- Must Buy For

- Companies Mentioned

Get your report flyer

Download the flyer to learn more about:

- Report structure

- Select definitions

- Scope of research

- Companies included

- Additional data points