Report Summary Determining Pug-in Opportunity for Value Chain Players & Evaluating the Change in Power Demand Scenario with Growth of EVs in India

Electric Vehicles Market in India - 2018

Share Report

License Type

In addition to single user license

- About

As automotive industry moves through second decade of the 21st century, dilemma over whether or not electric vehicles (EVs) in India will become a key part of the mainstream local car-buying market remains largely unchanged, though biggest disruption is anticipated by mid 2020’s

Government support & subsidies key to embelish ev markets in India – paradigm for successful endorsement shall be replacement of ice in phased manner from the country

Harping the focus on EV’s are ever tightening CO2 emissions regulations and the investment of billions in subsidies and incentives by governments around the world, encouraging greater industry participation and adoption in the marketplace, hence expected to be a no different in India either. By 2020, CO2 emissions will be regulatory limited at 95 g/km as an average value throughout the vehicle fleet, which means that distinct Bharat norms have to be placed for ICE drive trains in the country.

In order to outbalance the CO2 performance of cars with higher emission values, OEMs need to have zero-emission vehicles like the EV. The U.S. Government recently invested $5 billion in electric cars, including loans and grants to automakers and battery producers, spending on charging stations, and $7,500 tax credits to car buyers with the goal of having another one million EV’s on U.S. roads by 2020 post FY 2015. In addition, more and more global cities will become networked, integrated and branded smart cities, where electric vehicles can be ideally deployed in order to offer a better, cleaner urban mobility experience and help balance future smart electricity grids.

Although, GoI has announced initiative like FAME & NEMMP but penetration shall happen only when the end consumer is finds the EV as cost competitive with compatible charging infrastructure available publically in the country starting from tier 1 and tier 2 cities in a phased manner. Also, both forward and backward integration shall be key in terms of developing a robust electric vehicles market in the country by 2030. Having said that turning completely reliable upon eMobility by 2030 might be overambitious unless aggressive support environment for EV’s are established in the country.

KEY QUERIES ADDRESSED

- What shall be the Business Case for Electric Vehicles in India?

- What are the various growth factors for EV in India?

- What are the various growth barriers for EV in India?

- How much is the domestic manufacturing potential of India in EV segment?

- What are the available opportunities for EV Automakers in India?

- What are the available opportunities for Battery Manufacturers in India?

- What are the available opportunities for various supply chain players?

- What are the available opportunities for Discoms and Charging Infra service providers?

- What are the available opportunities for Smart Grid Players?

- What is the current Regulatory & Policy Landscape for EV in India?

BUSINESS CASE FOR ELECTRIC VEHICLES MARKET IN INDIA

- The overall electric vehicle market for storage in India is likely to be 4.7 GW in 2022. Over 50% of the market in 2022 will be driven by e-rickshaw batteries

- Need to counter air pollution coupled with rising fuel prices in India provides for booming business case for establishing a robust EV market

- Favorable policy interface such as FAME I and FAME II and pushing the adaptation of EVs through embellished incentives for end users

- Market orientation of Automobile industry OEMs to invest heavily in manufacturing of all 2W, 3W and 4W category of vehicles and provide for them as value integrator and supplier for EV charging infra as well builds up good industry outlook

- Smart cities and smart grid is promoted which are both the right enablers for developing a robust EV Market growth in India

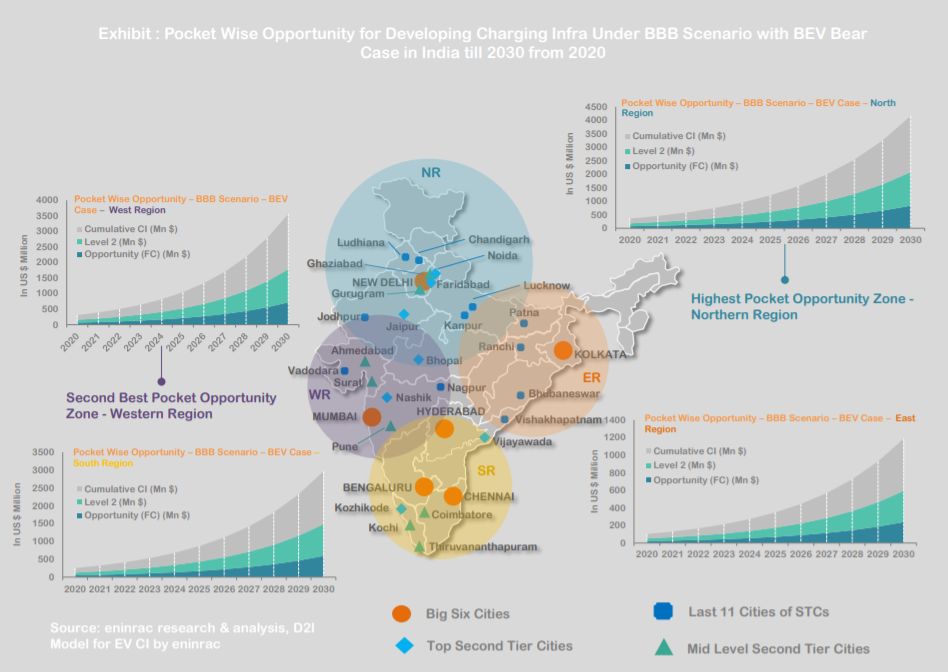

- Changing charging infrastructure industry structure in India with many global majors planning to enter the market which shall open up scores of opportunity for value chain players with increasing FDI

- PSU’s and many local private sector giants also have envisaged to enter this business segment which is promising for India. Further, with the likes of NTPC, Tata Power, BHEL & Fortum India the growth shall be faster than anticipated

- TOC

- USPs

- Key Highlights

- Report Insights

- Must Buy For

- Companies Mentioned

Get your report flyer

Download the flyer to learn more about:

- Report structure

- Select definitions

- Scope of research

- Companies included

- Additional data points