Report Summary Opportunity Examination for Key Value Chain Players, Power Distribution Companies & Renewable Energy Developers

Data Centre Market in India and Outlook Till 2025

Share Report

License Type

In addition to single user license

- About

Techno Electric & Engineering Company planning to invest USD 1 Billion in developing datacenters across major Indian cities

Globally, more than US$ 100 billion has flowed into the data center ecosystem from FY10 to FY20. This has seen investments from host of participants including pension funds, private equity firms, sovereign wealth funds and many other types of organization who have sensed the potential of sector. Leveraging this capital, the data center industry has expanded at lower cost as many funds have taken ownership positions in new companies rather than focusing of asset-by-asset acquisition. The significant capital influx demanded a transition at an equal pace upon technological levels. Thus, a thrust was seen in shifting workloads off-premises. This was done upon colocation and a mix of colocation and public & private cloud computing. This transition has seen largest cloud platform providers to become the most important players in many global markets and are likely to alter the data center sizing by a factor of 10. India is no different either from this transition. The 10 MW data centers that was sized impressively in FY10 now pales in competition with 30 MW leases that are being signed up.

India is establishing itself as a major presence in the digital economy. From internet connections to app downloads , both the volume and growth of its digital economy now exceeds those of most other countries. Government and the private sector are moving rapidly to spread high speed connectivity across the country and provide hardware and services to put Indian consumers & businesses online. Further, rising mobile penetration is leading to significant data proliferation amongst its consumers. India offers a large base of global users for digital mediums such as social media apps, IOT devices and OTT platforms. With the expected 5G implementation and data localisation norms, need for data storage to be closer to its users gains greater importance, with a view to measure down on latencies. Further, the advent of COVID 19 led to a push for working from remote and home locations which thrusted further the usage of cloud services and video conferencing. Also, a spike in the internet use has been observed more people were using to work, play or stay informed. This led to the data center staff being categorized in the country as essential in the level of mission critical even during lockdown days. Hence, development of data centres holds a good business case in India.

The Government of India has recognised digital infrastructure as an important focus area for sustained growth of India. Certain state governments have already provided incentives to encourage building of large data parks. Implementing a national policy will further augment these initiatives and boost the industry. The first step towards this aim has already been initiated by government with the release of a draft national policy for data centres.

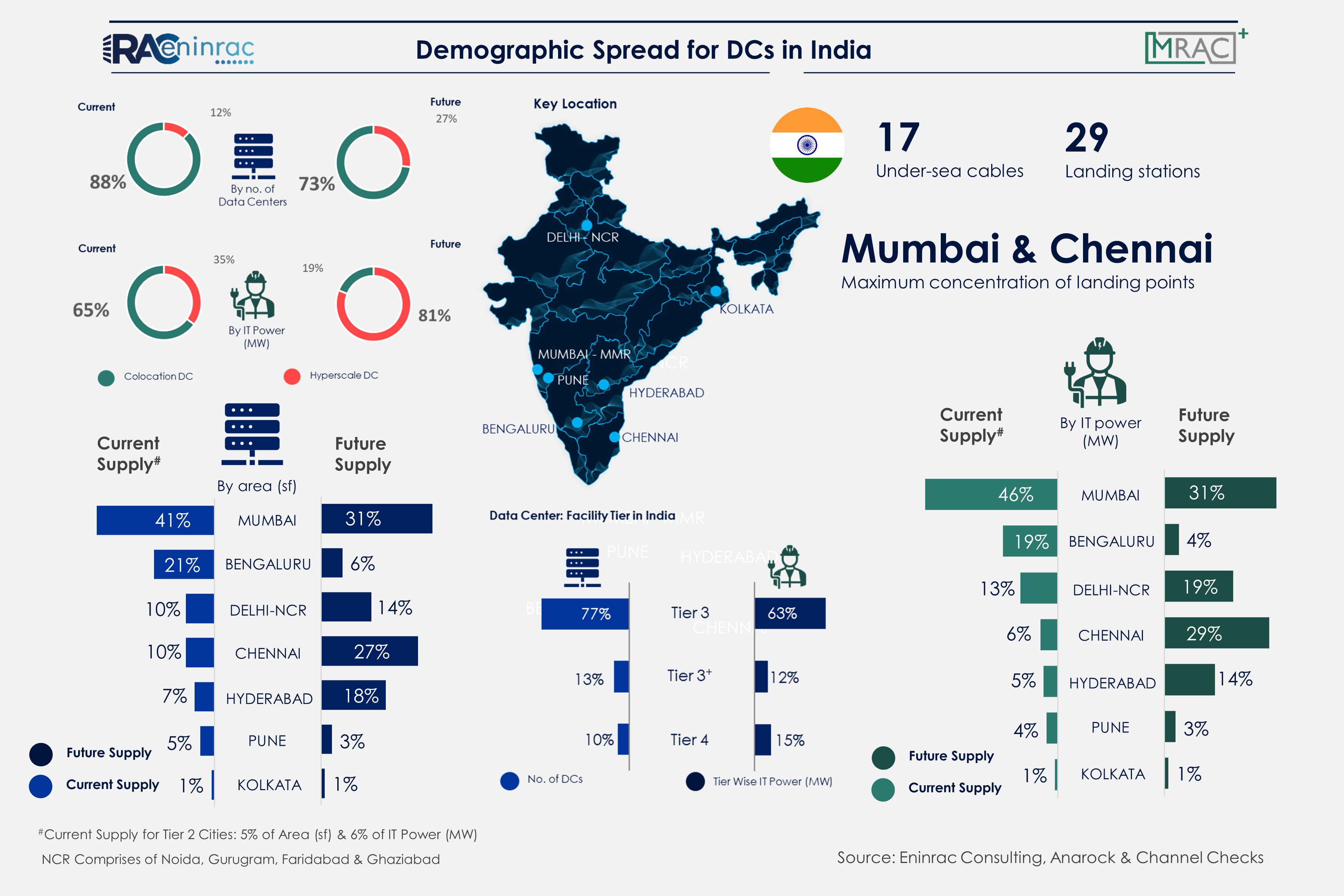

Data centers market in India has observed a good growth over the past decade due to the explosion of data through smartphones, social networking sites, ecommerce companies and government’s-initiated projects. In India, the market is dominated by third-party data centre providers like Net magic (NTT Com), CtrlS and telecom firms like Reliance, Tata Communications etc.

- TOC

- USPs

- Key Highlights

- Report Insights

- Must Buy For

- Companies Mentioned

Get your report flyer

Download the flyer to learn more about:

- Report structure

- Select definitions

- Scope of research

- Companies included

- Additional data points