Report Summary By usage (Domestic & transportation) for existing network, By upcoming/planned network (9th Bidding Round), By competitiveness & By region

City Gas Distribution (CGD) Market in India (Both CNG & PNG) & Outlook - 2022

Share Report

License Type

In addition to single user license

- About

Of the 86 GA on offer for the 9th round concluded has seen allocations for 90% of them i.e. 78 GA . The interesting fact for the concluded round is that of the total 19 companies allotted to work on the subsequent GA 3 are new entrants which opens up the area of CGD business as there exists a massive potential expand it for both piped gas transportation and gas based transportation. With smart cities coming into the fore with a enhanced rate the business case for CGD networks will certainly get embellished and may be a preferred model for established OMCs and pipeline felicitator like GAIL to engage on an integrator basis.

India’s aim to evolve as a gas based economy has seen the Government taking initiatives to push upon multiple facets to increase both the production and consumption of gas in the country. One such step is conducting bidding rounds for City Gas Distribution (CGD), which for now has crossed its 9th milestone by completing 9 rounds so far. Among the rounds completed till date the magnitude, size and scale for 9th round was biggest with 78 Geographical Areas (GA) being allocated to successful bidders.

Key Queries Resolved

- What shall be in-store for India for CGD Market?

- What shall be scale of opportunity for both domestic and foreign players on GA basis in India for CGD business post 5th round?

- What shall be the opportunity for both domestic and foreign players under gas transmission pipeline especially installed for CGD business in India and its outlook?

- What shall be the opportunity for both domestic and foreign players for establishing city gas stations in India and its outlook as per GA?

- What shall be the opportunity for both domestic and foreign players for establishing CNG stations in India and its outlook as per GA?

- What shall be the opportunity for both domestic and foreign players for establishing PNG network in India and its outlook as per GA?

- What shall be the opportunity for pipeline manufacturers, OEMs and Project Management Companies under CGD business of India?

- What shall be the key drivers and barriers to robust market growth?

- Which company shall lead the CGD business in India till 2022?

BUSINESS CASE FOR CITY GAS DISTRIBUTION (CGD) MARKET IN INDIA (BOTH CNG & PNG)

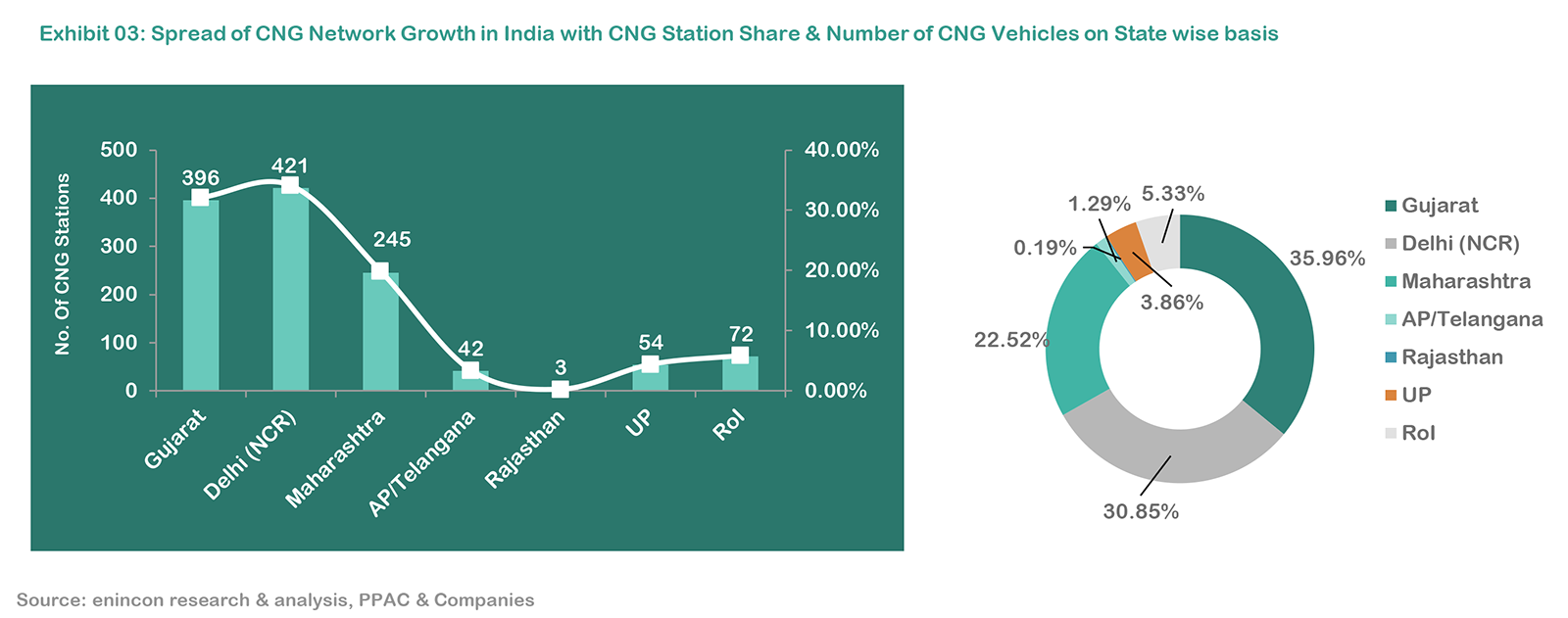

- Gaining importance and competing against liquid fuel like petrol & diesel is becoming a brimming ground for expanding CGD networks in the country

- CGD’s 9th Bidding round to increase presence in 174 districts with investment to the tune of INR.600-800 Billion

- Priority allocation of domestic gas to drive both volume and profitability. As per the policy, CGD (CNG and domestic PNG), fertilizer, power and LPG customers are classified as Priority Sectors. This in turn is likely to boost CGD operators to aggressively acquire new consumers without compromising margins from the incremental demand during the review period as the same demand was earlier met by import

- CGD industry getting a regulatory push which has become key growth enabler. India’s Supreme Court banned the registration of diesel vehicles with engine capacity of 2 liters or more in the Delhi, and ordered App based (Mobile) Taxies to convert their vehicles into CNG

- Geographical expansion to drive volume growth : The consistent addition of new geographies would not only likely to increase the consumption of natural gas in India but would also likely to boost the volume growth and thereby drive profitability for CGD companies in India

- Auto Fuel Vision and Policy 2025 favoring the use of CNG vehicles

- TOC

- USPs

- Key Highlights

- Report Insights

- Must Buy For

- Companies Mentioned

Get your report flyer

Download the flyer to learn more about:

- Report structure

- Select definitions

- Scope of research

- Companies included

- Additional data points