Report Summary Examining the Current Status & Scenario Wise Anticipated Developments Till 2022 + Project Tracker of Upcoming Coal Mines in Botswana, Mozambique and South Africa

African Coal Market – Examining the Trends & Outlook in Production, Demand, Supply, Exports, Imports & Pricing for Thermal and Metallurgical Coal

Share Report

License Type

In addition to single user license

- About

The local coal demand of South Africa is growing rapidly. But to satiate the increasing demand there exists a gap in the domestic availability of the same. Lack of investment is preventing the South African coal industry from capitalising on a period of relatively stable demand for thermal and metallurgical coal locally and abroad for sometime now. Also, the domestic demand-supply gap has lead to increase in the local price of coal and is moving towards parity with the export prices. It is significant to note that the price of coal having an average size of 6 mm ×25 mm has increased from R 796/tonnes in 2016 to R 1129/tonnes in 2018.

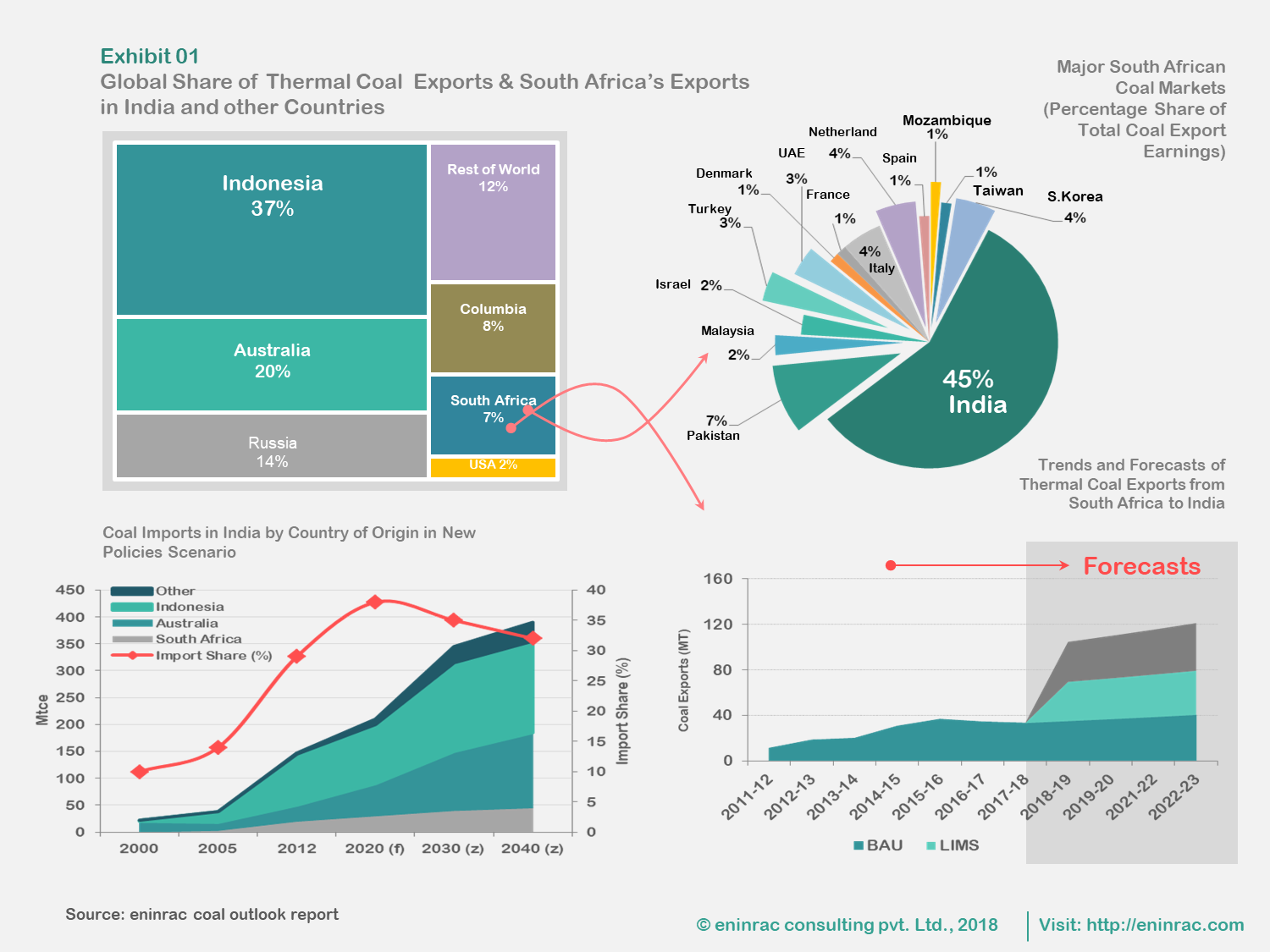

South Africa is among the largest coal producing nations across the globe and is a net exporter too. The country accounts close to 7% of total world’s steam coal exports in 2017. Over the past decade a certain shift has been in the coal consumption patterns across the globe. As many of the developed countries have switched coal with the clean fuels for generating electricity and many of them are in the process of doing the same, there have emerged new markets. Given the change witnessed in the demand centers,along with Indonesia and Australia, South Africa is shifting directions from Europe toward Asia, with India accounting for 70% of its exports to Asia in 2017. Further, it is expected that South Africa shall play a major role in fulfilling Asia’s coal demand, with a projection of 56 MMT steam coal exports to the Asian countries by 2020.

Key Queries Resolved

- What is the likely impact on coal exports of African countries with increasing local demand?

- What will be the regulatory and policy outlook for domestic/ exported coal in Africa?

- What will be the demand – supply dynamics of coking coal in Mozambique by 2022?

- What will be the demand – supply dynamics of non –coking coal in Mozambique by 2022?

- What will be the import dynamics of steam coal by South Africa till 2022?

- What will be the import dynamics of met coal by South Africa till 2022?

- What shall be the production of met coal in African countries till 2022?

- What shall be the production of thermal coal in African countries till 2022?

BUSINESS CASE FOR AFRICAN COAL MARKET

- The increased industrialization & urbanization is bound to level up the electrification requirements in Africa and South-East Asia. Since coal is the major source of power generation in the country , there will arise a need of stable coal supplies, hence the demand for thermal coal shall increase. It is pertinent to that the power demand in Sub-Saharan Africa is projected to hover around 679 TWH by 2020.

- Further, given the infrastructure development which the South African economies are anticipated to witness in upcoming years shall increase the steel production and supply levels in the country and so the demand of metallurgical coal shall increase.

- South Africa has extensive an largely unexploited, coal resources which when developed can form part of the Government’s effort to diversify the economy. Moreover, the demand pressures from Asian countries shall uphold the pace of domestic coal production in South Africa. Since, in many of the Asian economies domestic demand of coal outstrips supply the demand of seaborne thermal coal shall continue to grow strongly with demand projected to reach 1,100 MTs by 2025.

- The low price of coal compared to the high price of other fuel sources, whether oil or gas, provides a degree of longer term investment certainty that has generated a significant amount of interest in CTL fuels worldwide. Since, the country has abundant coal reserves CTL shall be most cost effective of the alternative fuel, particularly when overall operating costs and the low cost of coal are considered. Hence good opportunity exists for South Africa in this segment too.

- Coal mining industry in South Africa is highly dependent on diesel. Diesel cost ~ gas equivalent ranges from AUD 25/GJ to AUD 30/GJ. As per the CBM study results for the country indicates that coal beds within the study area contain an estimated gas in place resource of 60 trillion cubic feet (Tcf). The associated carbonaceous shales are estimated to contain an additional 136 trillion cubic feet resulting in combined 196 trillion cubic of gas in place. Hence, strong business case exists for converting coal to gas.

- Opportunity in production of gas and coal combustion products like fly-ash for cement production exists. Further, fertilizer production-of nitrogen based fertilizers complementing downstream activities in agriculture could also be a potential market associated with coal.

- TOC

- USPs

- Key Highlights

- Report Insights

- Must Buy For

Get your report flyer

Download the flyer to learn more about:

- Report structure

- Select definitions

- Scope of research

- Companies included

- Additional data points